Background

Novantas is a leader in analytic advisory services and technology solutions exclusively for financial institutions. It creates superior value for clients by providing information, analyses, and automated solutions that improve revenue generation — across pricing, product development, treasury and risk management, distribution, marketing, and sales management. It is recognised as the industry leader in the deposits space and in that area alone, it helps optimise returns for over $1 trillion worth of deposits on its client’s balance sheets.

Novantas focuses on “customer science” and helps clients develop a deeper understanding of their customer needs and behaviours, and translate those insights into rapid and sustainable improvement in revenue, growth, credit quality, and profitability with proprietary tools, analytics, technology solutions, and scoring models.

Business Issues in Banking

Retail banks have been operating in a weak recovery era following the 2008 financial crisis. General market growth has been modest at best, while the low interest-rate environment and new online market entrants have further compressed margins.

Always important, banks have now found it critical to retain and expand current customer relationships. Some are struggling to achieve this due to reduced customer interaction via their traditional branch network, as customers migrate their banking activities online.

With information-based competition exploding in the digital economy, banking executives increasingly are asking how “Big Data” can help. The expectation is that the combination of a vast customer information base, technology, and analytical methods will provide the required fuel in optimizing bank-customer relationships.

Big Data analytics offer extensive possibilities for “Hyper Personalized Experience” at a scale that was not previously possible. Building on the investment in CRM over the last decade, newer technologies are available to capture, analyse, and scale customer information, and predict cross-selling opportunities for banking products.

Hyper Personalization of Customer Experience

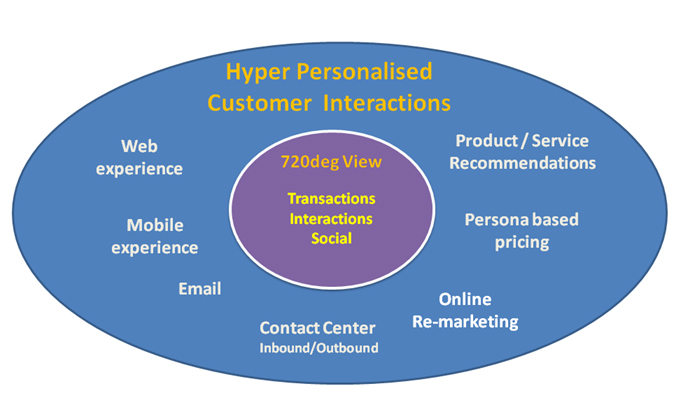

Many banks are gradually expanding the customer information footprint from across internal transaction systems (i.e. “360 degree” view) to include data from the web, mobile devices, chat and messaging services, and social media to provide a “720 degree” view of the customer.. While the full “720 degree” view may still be a while away, incremental benefits can be obtained from increasing the depth of information available about the customer.

To make sense of the information, however, and to leverage its possibilities, it must be organized in a way that reveals salient patterns of customer behaviour over time. This includes looking across channels, transactions, products and promotions to provide insight into customer needs and sensitivities.

With dwindling face time and growing customer reliance on impersonal electronic channels, the goal is to determine analytically what product/pricing combinations to offer to which customers, through which channels and at what time, so as to optimize both the value provided to the customer and the value of the relationship to the bank.

Persona-Based Deposit Pricing- A Practical, Powerful Application of Big Data Analytics

The web has given bank customers much more transparency about (and access to) deposit and credit offers nationally, plus more reference points on competitive prices with online banks, eroding geographic fencing and reducing margins.

Traditionally banks have offered unprofitable “honeymoon rates” to attract new deposits with the hope that the customer will keep their monies with the bank for many years to come thereby have recouped their investment based on customer inertia. Until now there has been little science applied to personalizing the price premium at an individual customer level.

This model, or more accurately series of models, enables banks to better predict which of their customers are likely to be profitable to attract for the banks deposit products and which groups can be repriced in a manner (and at what rate) where the gains from additional rate overcome any incremental balance losses.

Novantas has recognized that individual customers have a “money persona” which falls within a broad price elastic curve. Among the personas Novantas has characterized are:

- The Promotion Hopper: Constantly looking for best rates and may switch for even 25 basis point difference in rate

- The Occasional Shopper: Shops around occasionally or when there is a trigger like receiving a bonus

- The Convenience Seekers: Values the entire relationship with bank and does not shop for best in class products and/or rates in the market

Novantas has developed an analytical model that maps individuals’ personas by looking at:

- Shopping behavior (how often they shop)

- Rate sensitivity (how much of a premium needs to be offered to initiate action)

- Retention period (how long they are likely to keep monies with bank)

Results

At one major US bank with 10 million+ customers where this solution has been implemented, the results have been outstanding:

- Marketing execution costs reduced by 50% by focusing on high potential customers

- Focus on incremental accounts reduced, lowering promo expense by as much as 60% and 12 month deposit growth by less than 25%

- Retention offers limited, which reduced promotion expense by 10% and balance retention by only 3% with nominal change in customer retention.

The full slate of loyalty and propensity analytics, combined with past behaviours, helped these progressive players to avoid “waking the sleeping giant” of easy-to-activate, rate-sensitive customers. To fully realize the potential of these analytics, the final enablement is developing the direct communication strategies required to elevate response rates to levels as high as mass marketing from relevant segments.

Solution

The Novantas solution provides a new level of precision-targeted pricing, to reach those customers for whom price will drive incremental volume, and for whom the persistence of the deposit and/or utilization of the credit will yield positive economics over the estimated lifetime of the balance (including the incremental cost of the incentive).

It has provided new opportunities for customer acquisition, using digitally refined targeting to find prospects with similar profiles. This has reduced the reliance on broad campaigns that erode value by paying incentives where they are either not required or where the customer’s behaviour will likely not deliver the intended economics (e.g. promotion hoppers).

Having identified target populations based on the appropriate offer (price or otherwise) for balance consolidation, Big Data’s machine learning capabilities equip the bank to rapidly test multiple dimensions of offers (price level, channel, message, conditions) against target populations, not only to optimise who should get an offer, but also to pinpoint which type of offer is the most economic over time.

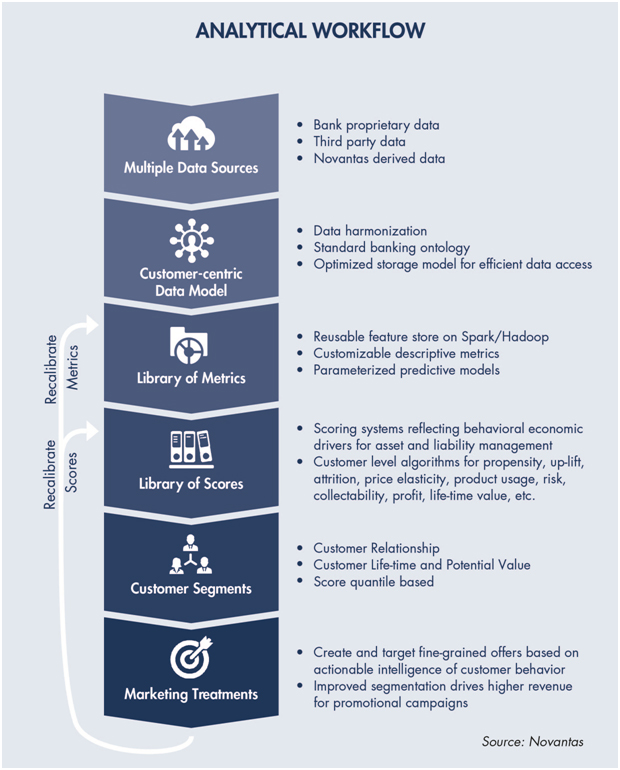

To conduct the above customer journey analysis in real-time, Novantas has built an application called MetricScape to run on top of a Cloudera-based Hadoop and Spark cluster that can crunch over a thousand business metrics per customer in sub-second response time. This analytical workbench allows data scientists to collaborate within a comprehensive governance framework and helps accelerate model development by giving them easy access to a retail banking data model that holds many years of detailed customer history including deposit history, customer holding, detailed transaction history, promotion offers and extensive third-party data.

This application acts as a librarian of sorts for customer and financial data metrics, providing a business metadata governance layer that tracks things such as data lineage, definitions and dependencies.

Its analytical workflow (see below) helped a team of data scientists pull together relevant data sets for analysis. It allows banks, in general, to look at customer account histories, the results of previous marketing campaigns and other data to segment millions of bank customers based on their likely responsiveness to planned promotional offers.

Novantas has built their solution using Cloudera Hadoop/Spark (EDW) software which is deployed on cloud infrastructure atAWS. The ease of scalability, maintenance and upgrade via Cloudera Manager and Director has allowed Novantas to minimise investments required for infrastructure management.Cloudera EDW’s secure approach to sensitive PII information gave Novantas and their customer the assurance that customer data was protected.

Summary

Economic and competitive forces have compelled banks to focus on not only maintaining but increasing their existing retail customer relationships and deposits while simultaneously maintaining or increasing the profitability of this business. The Novantas solution has enabled banks to conduct more profitable deposit business by using state-of-the-art Big Data and analytics technologies and techniques.

Their models combined with the Cloudera Hadoop and Spark’s ability to store and process massive amounts of information at a low cost, have enabled banks to granularly target customers based on their responsiveness to price and the likely retained value from that offer. This capability delivers radical new opportunities for banks and is proving to be a genuine competitive advantage over new entrants into the market.

BigInsights is a research & consulting firm focused on Big Data analytics solutions and technologies. BigInsights is focused on helping companies harness data driven innovation for customer and operational insights and industry specific applications. See www.BigInsights.co for further details.

Cloudera delivers the modern platform for data management and analytics. Cloudera provide the world’s fastest, easiest, and most secure Apache Hadoop platform to help you solve your most challenging business problems with data. See www.Cloudera.com for further details.